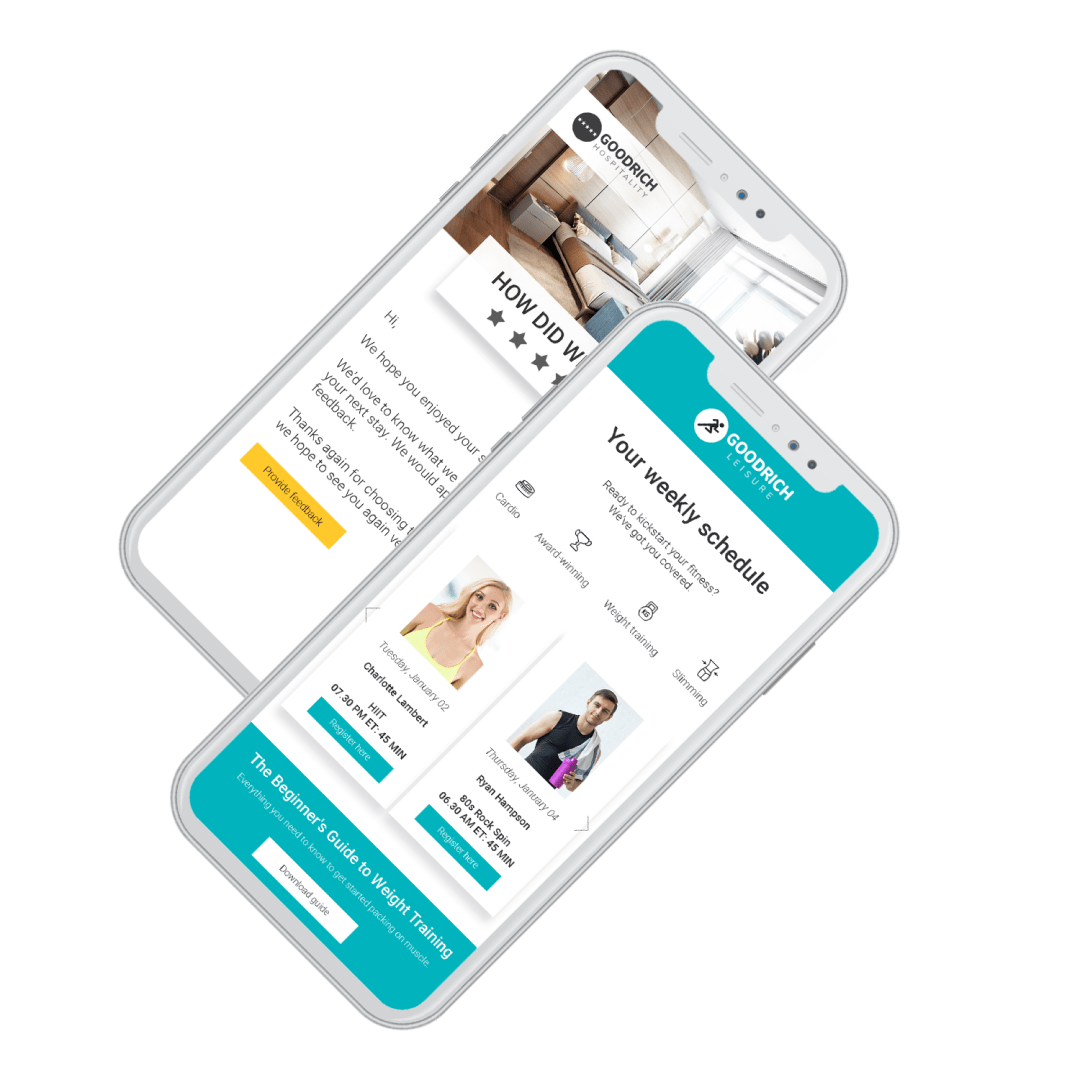

The complete multi-channel SaaS marketing platform

The all-in-one SaaS marketing platform that really boosts your revenue and profit

With email, automation, SMS, print, surveys, and reporting all in one easy-to-use platform, we make it simple to hone your marketing and track your Return on Investment.

Our industry solutions

Save time

Save valuable time and resources by identifying high-value clients within your database.

Save money

With all your digital and print marketing in one place, track your marketing spend.